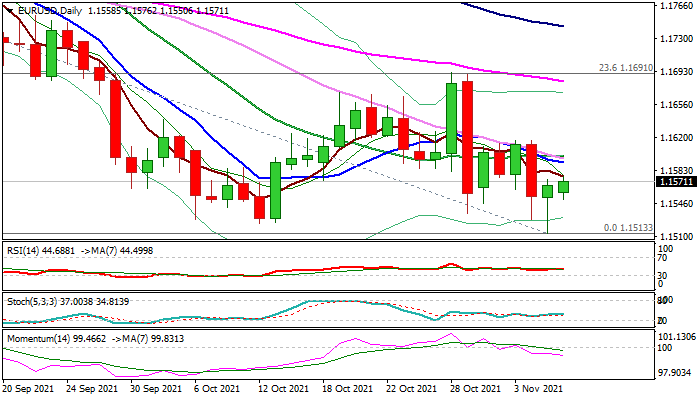

Bears continue to face strong headwinds from 1.15 support zone

The Euro stands at the front foot in early Monday, following strong downside rejection on Friday that left a hammer candle, generating initial reversal signal.

Multiple downside rejections on approach to pivotal Fibo support at 1.1492 (50% retracement of 1.0635/1.2349 rally) in past four weeks and also failures to clearly break below 200WMA (1.1565), suggest that larger bears face strong headwinds at this zone.

Bearish studies on daily and weekly chart suggest prolonged consolidation before bears resume, with clear break of 1.1492 support to spark fresh acceleration lower.

Four-week consolidation top (1.1692) is also broken Fibo 38.2% of 1.0635/1.2349 and Fibo 23.6% of 1.2266/1.1513 bear-leg, marking strong resistance which is expected to cap and bears in play.

Only break here would put bears on hold for stronger correction.

Res: 1.1592; 1.1616; 1.1665; 1.1692

Sup: 1.1550; 1.1525; 1.1513; 1.1492