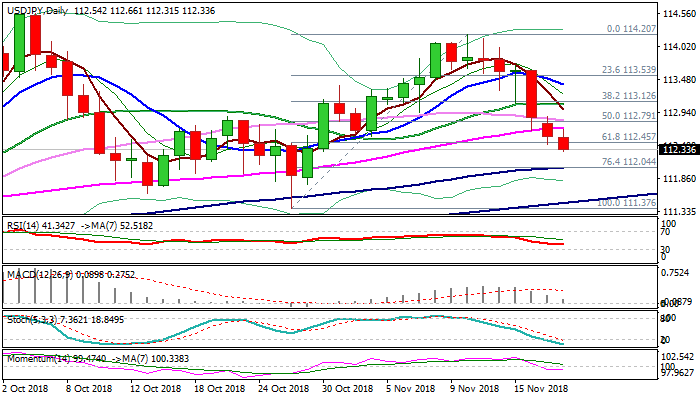

Bears could test daily cloud base as Friday’s long bearish candle weighs

The pair continues to trend lower, extending steep fall into third straight day and looking for test of daily cloud base (112.16) after fresh bearish extension on Tuesday broke below 112.45 pivot (Fibo 61.8% of 111.37/114.20) and generated bullish signal.

Last Friday’s long bearish daily candle (the biggest one-day fall in Nov) continues to weigh, along with daily MA’s in bearish setup and strengthening bearish momentum.

Close below broken Fibo support at 112.45 is needed to confirm bearish stance, while sustained break below cloud base (112.16) and 112.04 (Fibo 76.4% / 100SMA) would generate stronger bearish signal.

Corrective upticks are expected to hold below daily cloud top (112.89) and keep bears in play.

Res: 112.45; 112.70; 112.89; 113.06

Sup: 112.16; 112.04; 111.77; 111.62