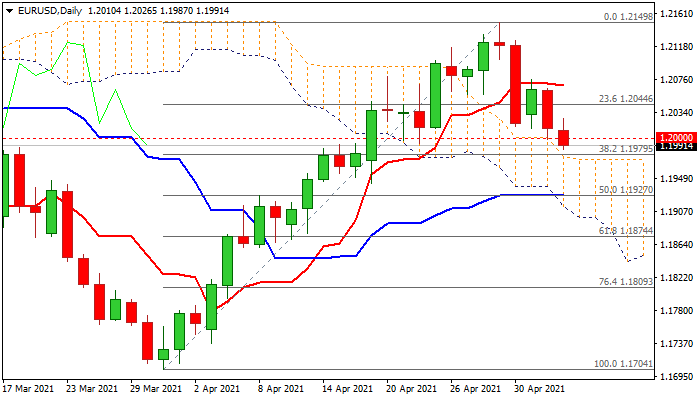

Bears crack key support zone and risk deeper fall

Bears probe through psychological 1.20 support in early European trading on Wednesday and risk deeper fall.

Bull-trap above 1.2102 Fibo barrier and last Friday’s massive bearish candle weigh on Euro as bears pressure next key supports at 1.1979/73 (Fibo 38.2% of 1.1704/1.2149/daily cloud top), loss of which would generate strong bearish signal for extension towards 1.1941/27 (200DMA / 50% retracement) and 1.1899 (daily cloud base) in extension.

Weakening daily studies (momentum is approaching negative territory and 5/10/20 DMA’s turned to bearish setup) support the action, but oversold stochastic warns that bears may face headwinds.

Upticks are expected to stay below broken 100DMA (1.2049) and offer better selling opportunities.

Res: 1.2015; 1.2026; 1.2049; 1.2061

Sup: 1.1979; 1.1973; 1.1941; 1.1899