Bears face headwinds from key supports

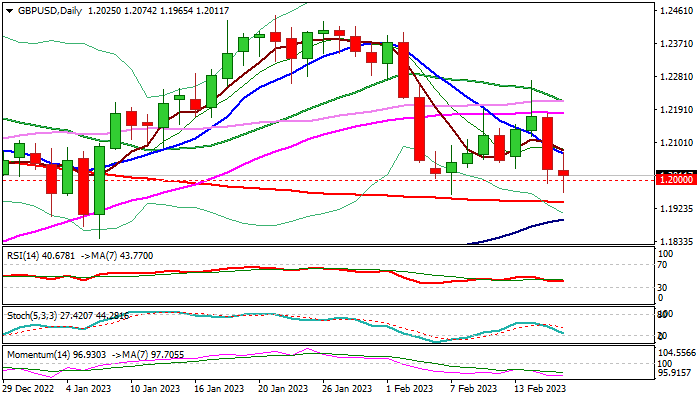

Cable remains firmly in red on Thursday and extends previous day’s strong fall (down 1.1% for the day) to almost fully retrace 1.1960/1.2269 recovery leg.

Fresh weakness spiked to 1.1965, but subsequent bounce signaled strong headwinds from pivotal supports at 1.1960/40 (Feb 7 low / 200DMA).

Upticks are likely to be limited and capped by strong barrier at 1.2094 (broken daily cloud top, reverted to resistance), as daily studies are predominantly negative, while long upper shadows of weekly candles of past two weeks signal strong offers.

Violation of 1.1960/40 pivots would risk test of next key support at 1.1841 (Jan 6 trough) and possible stronger acceleration, as break here will complete a double-top pattern (1.2447).

Res: 1.2033; 1.2094; 1.2115; 1.2146

Sup: 1.1960; 1.1940; 1.1900; 1.1841