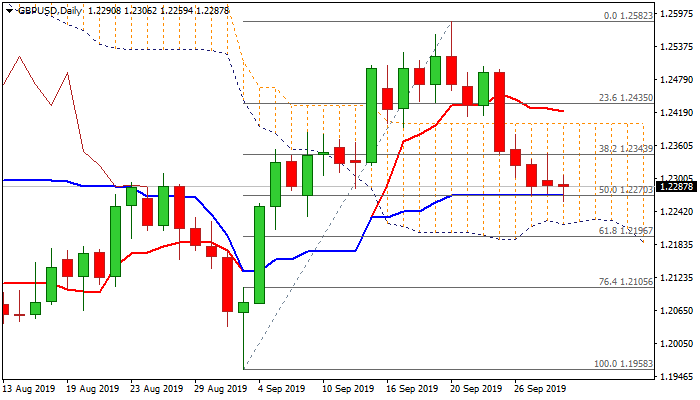

Bears face headwinds from 1.2270 support and may extend consolidation before continuing

Cable cracked important support at 1.2270 (50% retracement of 1.1958/1.2582 / daily Kijun-sen) in early European trading on Tuesday, after support contained action of past two days.

Break lower was so far short-lived as sterling received support from better than expected UK Manufacturing PMI (Sep 48.3 vs 47.0 f/c), but positive impact is expected to be limited, as indicator stays below 50 threshold for the fourth consecutive month that sends negative signal.

Extended consolidation above 1.2270 cannot be ruled out on repeated failure to close below, as daily stochastic is oversold and momentum is flat.

Negative outlook could be expected while broken Fibo support at 1.2343 (38.2%) caps, as the pair holds in red for the fifth straight day, with final break lower to expose next key levels at 1.2222 (daily cloud base) and 1.2196 (Fibo 61.8% of 1.1958/1.2582).

Only sustained break above 1.2343 would sideline immediate bearish threats.

Res: 1.2306; 1.2343; 1.2378; 1.2392

Sup: 1.2270; 1.2259; 1.2218; 1.2196