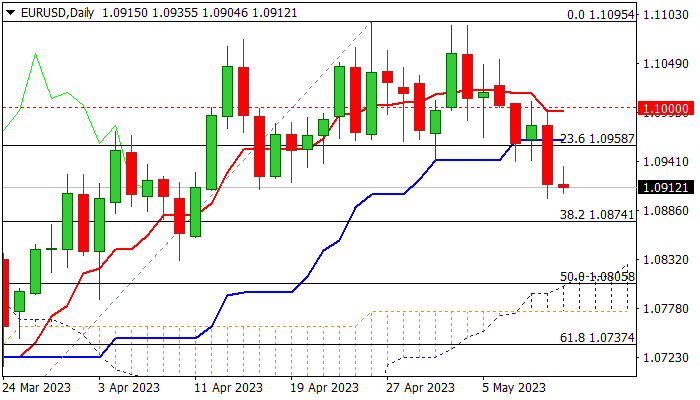

Bears gain traction on break of pivotal Fibo support / recent range floor

The Euro remains at the back foot in early Friday following 0.6% drop on Thursday, which generated bearish signal on eventual close below pivotal Fibo support at 1.0960 zone (23.6% retracement of 1.0516/1.1095 rally / daily Kijun-sen).

Eventual break and close below 1.0960 after several rejections at this zone signals an end of near-term directionless mode (the price was moving within 1.0940/1.1095 range for over three weeks) and shifts near-term focus lower.

Weakening daily studies (rising negative momentum / 10/20DMA bear-cross) contribute to negative near-term outlook.

Fresh bears look for confirmation on weekly close below 1.0960, with extension through next key Fibo level at 1.0874 (38.2% retracement) to reinforce near-term bearish structure and open way for extension towards the top of rising and thickening daily cloud (1.0812).

Broken 1.0960 support reverted to solid resistance which should keep the upside protected and maintain fresh bearish bias.

Only bounce and close above 1.0995/1.10 (daily Tenkan-sen / psychological) would neutralize downside risk and revive bulls.

Res: 1.0940; 1.0960; 1.1000; 1.1032

Sup: 1.0900; 1.0874; 1.0831; 1.0812