Dollar on track for the biggest weekly advance in 11 weeks

The dollar index remains constructive and extends higher in European trading on Friday, following 0.7% advance on Thursday.

The greenback benefited from renewed safe-haven demand, sparked by growing concerns over US debt ceiling case and further worries about banking sector crisis.

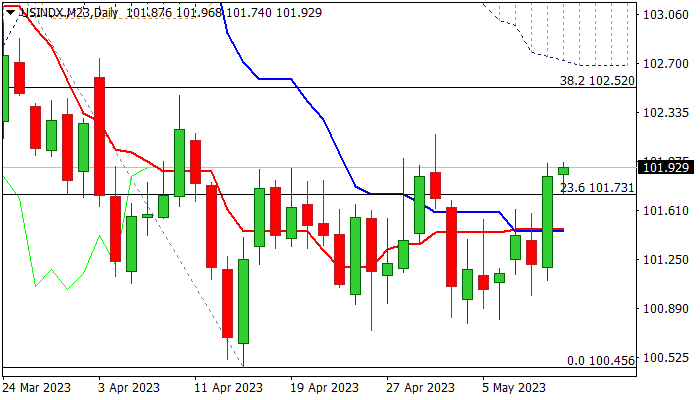

The price action is heading towards the top of near-term range (100.45/102.17), with sustained break higher to expose next targets at 102.52/68 (Fibo 38.2% of 105.85/100.45 fall / base of falling and thickening daily cloud) and add to initial reversal signal, if dollar-favorable conditions persist.

The dollar index is also on track for the biggest weekly gain since mid-February, which adds to positive near-term outlook, along with improving daily techs on rising bullish momentum, keeping prospect for break above current congestion,

On the other hand, larger picture shows that the greenback remains in a downtrend from 114.72 (Sep 2022 multi-year peak), sparked and still mainly driven by cooling US inflation, while the latest data generated initial signal of slowing labor market and Fed signaled a pause after the last 25 basis points rate hike, which would add pressure on greenback and weigh on current recovery.

Res: 102.17; 102.52; 102.68; 103.15

Sup: 101.73; 101.52; 100.66; 100.45