Bears hit six-week low on negative fundamentals

Copper fell to new six-week low at $2.6575 on Wednesday in extension of strong fall in past two days.

The metal price was down nearly 3% on Mon/Tue’s bearish acceleration, sparked by fresh fears of escalation of US/China trade war as China is the biggest consumer.

Weaker than expected China’s PMI data, released earlier today (Oct Manufacturing PMI 50.2 vs 50.6 f/c and Non-Manufacturing Oct 53.9 vs 54.9 f/c), showed that manufacturing sector grew at the slowest pace since mid-2016, signaling further slowing in the China’s economy and diminishing the outlook for metal’s demand.

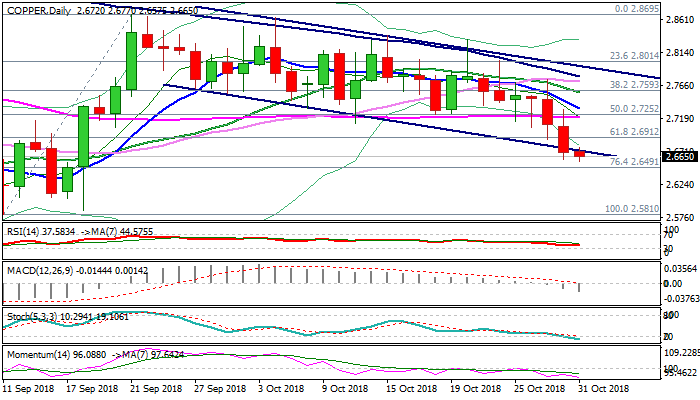

Tuesday’s break and close below pivotal supports at $2.6912 (Fibo 61.8% of $2.5810/$2.8695) and $2.6745 (bear-channel support line) generated bearish signals for extension of bear-trend from $2.8695 (21 Sep high).

Daily tech in strong bearish setup add to negative outlook, as bears pressure Fibo support at $2.6491 (76.4%) break of which would open way towards $2.6051 (200WMA) and higher base at $2.58 zone.

Broken channel support line and Fibo level ($2.6724/$2.6912) mark initial resistances, with broken sideways-moving 55SMA ($2.7227) expected to cap stronger corrective upticks.

Res: 2.6724; 2.6912; 2.7227; 2.7338

Sup: 2.6575; 2.6491; 2.6051; 2.5875