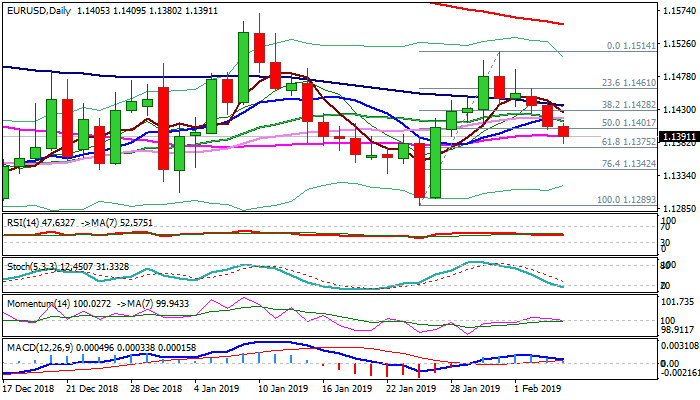

Bears need confirmation on close below daily cloud

The Euro remains in red for the third straight day and probed through daily cloud (1.1393/82) and 55SMA (1.1391) in early Wednesday’s trading, as fresh negative signal came from downbeat German factory orders (Dec -1.6% vs 0.3% f/c).

Tuesday’s close well below key supports at 1.1428 (Fibo 38.2% of 1.1289/1.1514) and 1.1417 (converged 10/20/30SMA’s) further soured near-term sentiment after US President Trump’s address to State of the Union sent dollar higher across the board.

Euro’s bearish stance is boosted by rising negative momentum and daily MA’s turning into bearish setup.

Bears need confirmation on close below daily cloud that would open way for test of next pivotal support at 1.1375 (Fibo 61.8% of 1.1289/1.1514) and extension towards 200WMA (1.1332).

Meanwhile, bears may take a breather on oversold stochastic, with broken diverging MA’s marking solid resistance at 1.1413/17 and guarding broken Fibo level at 1.1428, which is expected to cap upticks and maintain bearish near-term bias.

A batch of US data, due later today, is in focus for fresh direction signals.

Res: 1.1400; 1.1417; 1.1428; 1.1436

Sup: 1.1375; 1.1342; 1.1332; 1.1300