Bears regain control after Tuesday’s strong downside rejection

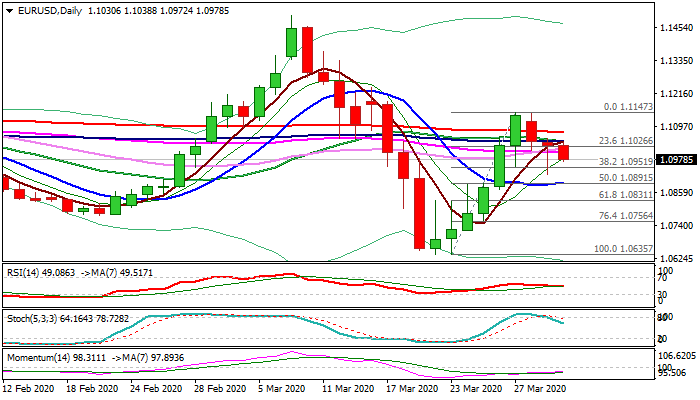

The Euro remains in red and penetrated daily cloud again on Wednesday, after previous day’s action showed strong downside rejection and close above cloud top (also close above initial Fibo 23.6% of 1.0635/1.1147 support) of, leaving long-tailed bearish candle.

Fresh weakness emerged after the action in Asian session was capped by falling and thickening hourly Ichimoku cloud.

Near-term outlook is negative as rising demand for safety in cash dollar weigh on Euro and comments that Italy’s economy is expected to contract 6% on coronavirus crisis that adds to expectations for German economy’s 5.4% decline.

Bears focus again cracked pivot at 1.0951 (Fibo 38.2% of 1.0635/1.1147) with eventual close below here to generate bearish signal for extension towards key support at 1.0891 (daily cloud base / 50% retracement / daily Tenkan-sen).

Daily cloud top again marks initial resistance with other strong obstacles at 1.1044 ( converged 20/100DMA attempting to form bear-cross) and 1.1076 (200DMA), which need to stay intact and keep bears in play.

Res: 1.1008; 1.1026; 1.1044; 1.1076

Sup: 1.0951; 1.0926; 1.0891; 1.0869