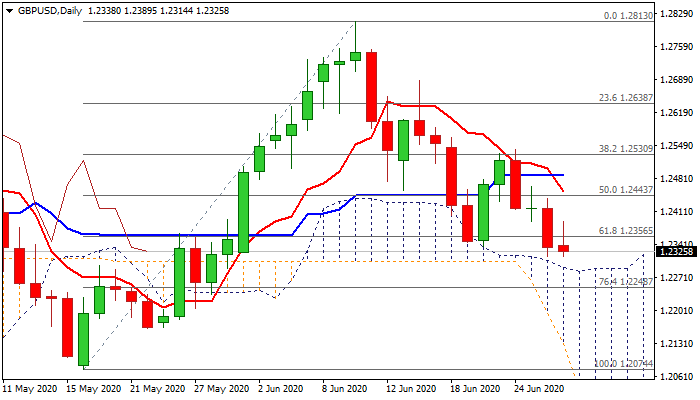

Bears regained control after recovery stalled; daily cloud top comes under pressure again

Cable dipped to the session low at 1.2314 in Europe after recovery stalled at 1.2389, keeping Monday’s action in red for now.

Last Friday’s long bearish candle (the pair was down 0.67% for the day) and close below 1.2356 (Fibo 61.8% of 1.2074/1.2813) weigh on Monday’s action, as bears look for repeated attack at the top of thick daily cloud (1.2292), which marks next pivotal support.

Daily studies are in full bearish setup and support further weakness, although oversold stochastic may slow bears.

We look for repeated close below 1.2356 Fibo level to confirm bearish signal for attack at cloud top and possible extension towards 1.2248 (Fibo 76.4%).

Alternatively, failure to close below 1.2356 would signal consolidation with bears to remain in play as long as holding below broken 55DMA (1.2419).

Traders turn focus towards EU?UK trade talks which resume today, with uncertainty about success of negotiations, keeping the pound under pressure.

Res: 1.2356; 1.2389; 1.2419; 1.2437

Sup: 1.2314; 1.2292; 1.2248; 1.2204