Better than expected German data inflate Euro but thick daily cloud weighs

The Euro rose to 1.09 handle on Monday, inflated by better than expected German Ifo data (May 79.5 vs 74.2 previous and 78.3 f/c).

German business morale improved in May as pandemic restriction eased, signaling the economy takes recovery path following dramatic fall previous months, with GDP data, released earlier today (Q1-2.2% from -0.1% previous and 2.2% f/c) confirming strong negative impact from pandemic lockdown and souring the sentiment.

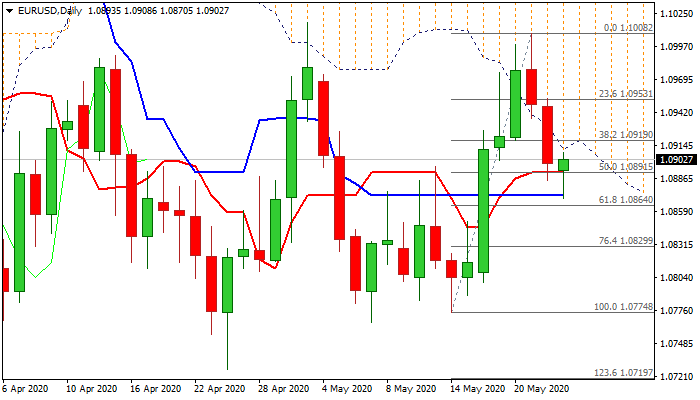

The pair hit one-week low (1.0870) in early European trading today, in extension of strong fall in past two days, but dips were so far contained by converged 20/30DMA’s and Fibo 61.8% of 1.0774/1.1008 upleg.

Daily techs lack clearer direction signal as MA’s are in mixed setup, bullish momentum is rising and stochastic heading south, but near-term action is weighed by thickening daily cloud (base lays at 1.0918).

If recovery stays capped by cloud, near-term bias would remain with bears and keep in play risk of breaking pivotal supports at 1.0873/64 (20/30DMA’s / Fibo 61.8%) and extending weakness towards key near-term supports at 1.0774/66 (14/7 May low).

Penetration and close within the cloud would ease immediate downside risk and signal further recovery towards key obstacles at 1.10 zone.

Res: 1.0918; 1.0953; 1.0960; 1.1000

Sup: 1.0884; 1.0873; 1.0864; 1.0830