Bitcoin – near term sentiment sours on early Tuesday’s 3% fall

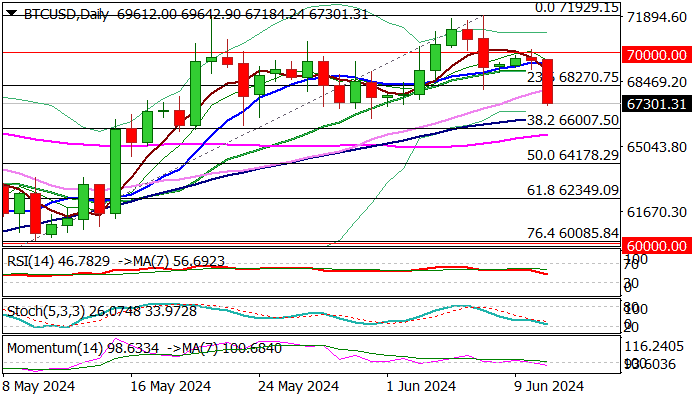

Bitcoin was down 3% in early Tuesday’s sharp selloff which signals continuation of a bear-leg from 71929 (June 7 peak).

Fresh bears emerged after a mild recovery was repeatedly capped by psychological 70K barrier, with drop marking so far the biggest daily loss since May1.

The price hit the lowest in two weeks, with breach of initial Fibo support at 68270 (23.6% of 56427/71929) and completion of failure swing pattern on daily chart, generating bearish signal.

Momentum indicator (14-d) broke into negative territory and the price slid below 10/20DMA’s, weakening near-term structure, with Friday’s twist of daily cloud, also expected to attract.

Bears eye 100DMA (66529) which guards pivotal 66K support zone (higher base / Fibo 38.2%), loss of which would generate reversal signal and spark further weakness.

Near-term action should stay capped by broken Fibo level at 68270 and broken daily Kijun-sen at 68512, to keep near-term bias with bears.

Res: 68062; 68270; 68512; 69642

Sup: 66533; 66529; 66000; 65701