GOLD – bears are taking a breather ahead of US CPI data / FOMC policy decision

Gold price edged lower in early trading on Tuesday, following Monday’s limited consolidation of nearly 4% drop on Friday.

Near-term outlook remains bearishly aligned after a massive losses last Friday, sparked by strong US jobs data and reports that China’s central bank paused gold purchases in May.

Markets shift focus towards this week’s key events, release of US inflation data and Fed rate decision, both due on Wednesday, with expectations that consumer prices would barely ease, although may cause increased volatility on Wednesday, in case May figure diverges from forecasted levels.

The US central bank does not have much space to maneuver, particularly after much higher May payrolls almost removed expectations for first rate cut in September from the table, with growing signals that the Fed would stay on hold until November.

This will be a negative scenario for gold and would further increase pressure on metal’s price in the near-term, allowing for deeper correction of $1984/$2450 bull-leg.

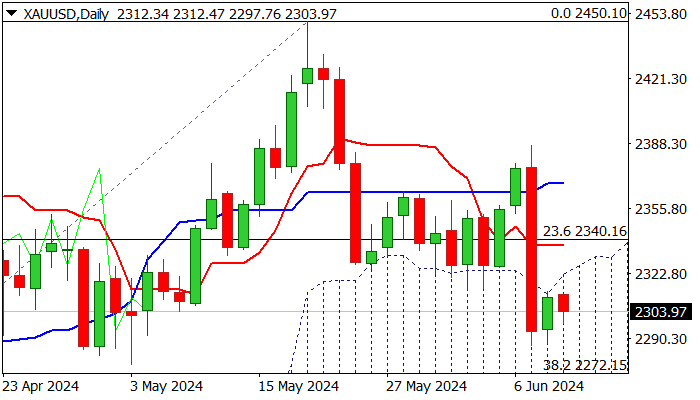

Technical picture on daily chart is weakening, with initial bearish signals generated on penetration and repeated close within thick daily cloud, negative momentum and MA’s (10/20/55) in bearish setup and forming bear-crosses.

However, oversold stochastic on daily chart may produce headwinds to bears, approaching pivotal Fibo support at $2272 (38.2% retracement of $1984/$2450).

Near-term action is likely to stay in extended consolidation and a quiet mode until Wednesday’s releases, ideally to be capped by daily cloud top ($2322) and not to exceed daily Tenkan-sen ($2337) to maintain bearish near-term bias.

Firm break of $2277/72 pivot, to further weaken near-term structure and expose targets at $2228/17 (daily cloud base / 50% retracement).

Conversely, violation of Tenkan-sen line ($2337) would ease bearish pressure, but sustained break above daily Kijun-sen ($2368) required to neutralize bears.

Res: 2322; 2337; 2359; 2368

Sup: 2286; 2272; 2228; 2217