Bitcoin remains at the back foot but still lacks clearer direction signals

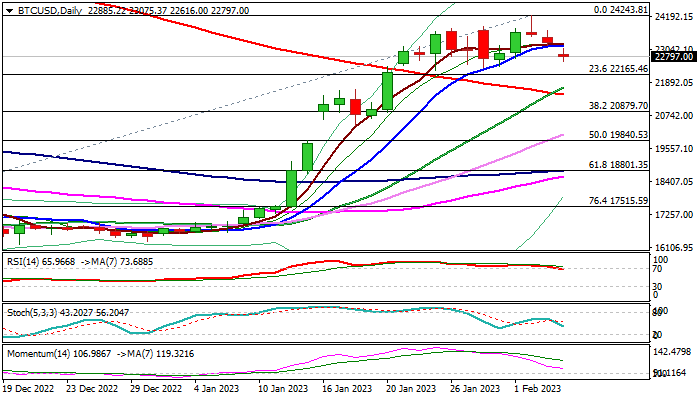

Monday’s gap-lower opening confirms that near-term structure is weakening, although the price is still holding within the range between 22310 and 24243 that keeps on hold risk of deeper pullback so far.

The bitcoin lost traction on soured risk sentiment, while growing signs that the Fed would remain on track for further rate hikes, following upbeat US jobs data, add to downside risk.

January’s strong advance left large bullish monthly candle which completed the first phase of reversal pattern on monthly chart, though more work at the upside is still required for confirmation.

Larger short-term bullish bias is expected to remain in play while consolidation moves between the range boundaries, while break of pivotal supports at 22310/22165 (range floor / Fibo 23.6% of 15437/24243 rally) would signal pullback and expose targets at 21471 (200DMA) and 20879 (Fibo 38.2%).

Technical studies on daily chart are mixed (bullish momentum is fading and south-heading RSI emerged from overbought territory, while the most of MA’s remains in bullish setup, with 20/200DMA golden cross being formed) and so far lack clearer direction signal.

Watch pivotal points (22310 – bearish) or 23277 (daily Tenkan-sen – bullish) for initial signals.

Res: 23147; 23277; 23704; 23868

Sup: 22616; 22310; 22165; 21471