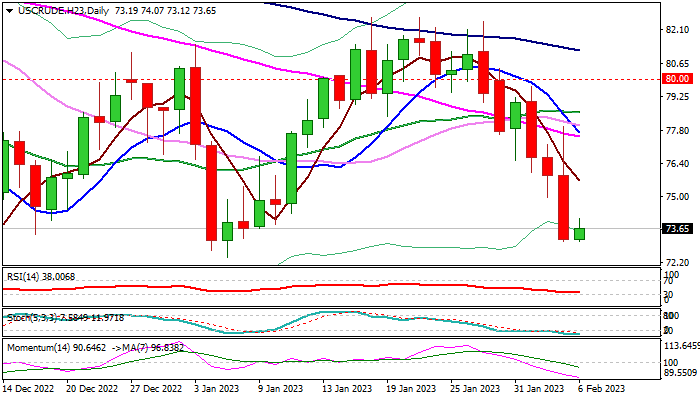

Limited upticks to keep bears in play for fresh attempts lower

The WTI oil is consolidating above one-month low after falling by 8.5% last week, deflated by by fresh signals about further rate hikes and growing concerns that slower growth in major economies would hurt global demand.

Markets reacted on prevailing story about recession, but focus turns towards China, world’s second largest economy and the biggest oil importer, which is expected to be key driver of demand.

Oversold daily studies suggest that bears may stay on hold above key near-term support at $72.44 (Jan 5 low), with corrective upticks to stall under Fibo barrier at $76.73 (38.2% of $82.64/$73.08) to keep intact key barrier at $76.99 (base of thick daily cloud).

Res: 74.07; 74.95; 75.34; 76.73

Sup: 73.08; 72.44; 70.23; 70.00