Bitcoin remains weak and nears key support zone; FOMC and NFP eyed for fresh direction signals

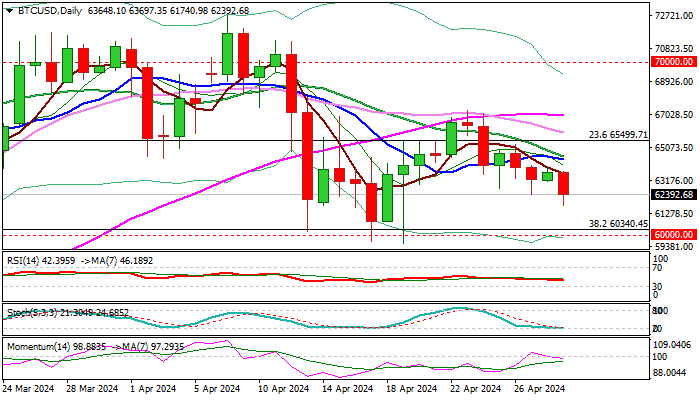

Bitcoin fell 2.5% on Monday, keeping weak near-term, as extension of the bear-leg from 67264 (Apr 23 lower top), brings in focus key supports at 60000 zone.

A cluster of strong supports between 60700 (daily cloud base), 60340 (Fibo 38.2% of 38501/73839) and 60000 (psychological) makes a breakpoint, loss of which would generate reversal signal and spark deeper correction of 38501/73839 uptrend, with 56000 zone (50% retracement) marking next target.

Technical studies on daily chart are weakening as 14-d momentum returned to negative territory and MA’s 10/20/55 are in bearish setup.

However, oversold conditions may boost headwinds expected at strong 60000 support zone.

Markets focus on Fed rate decision and US labor data, as key economic events this week, which are expected to provide fresh direction signals.

Repeated failure to clearly break 60k supports would keep the action in extended range, but with increased downside risk while under converged 10/20DMA’s (64500 zone).

Only sustained break above 55DMA (66920) would sideline bears.

Res: 64000; 64500; 65950; 66920

Sup: 61000; 60700; 60340; 60000