USDJPY pulls back from new multi-decade top on suspected intervention

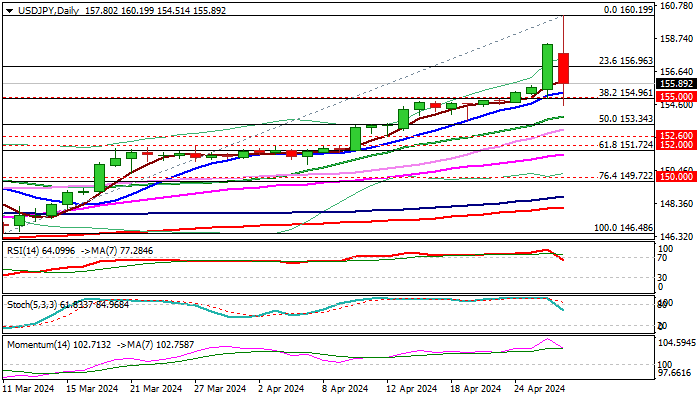

USDJPY cracked psychological 160 barrier and hit new multi-decade high early Monday, with subsequent sharp pullback to 155.00 zone on suspected intervention.

Fresh weakness cracked pivotal 155 support area (Friday’s low / 10DMA / Fibo 38.2% of 146.448/160.19) but so far without sustained break lower, with close above this levels to mark a healthy correction and keep larger bulls intact for fresh push higher.

However, risk of deeper pullback exists, as daily indicators are in steep decline and RSI / Stochastic emerged from overbought zone and threats of further intervention by Japan’s authorities.

Extended dips below 155.00 should find solid ground above broken pivotal barrier, now acting as very significant support (152.60, broken Fibo 38.2% of 277.65/75.55) to keep broader bullish bias, with monthly close above this level, needed to confirm.

Conversely, firm break here would signal temporary top and open way for deeper correction.

Res: 156.89; 157.23; 157.73; 158.43

Sup: 155.00; 154.51; 153.80; 153.34