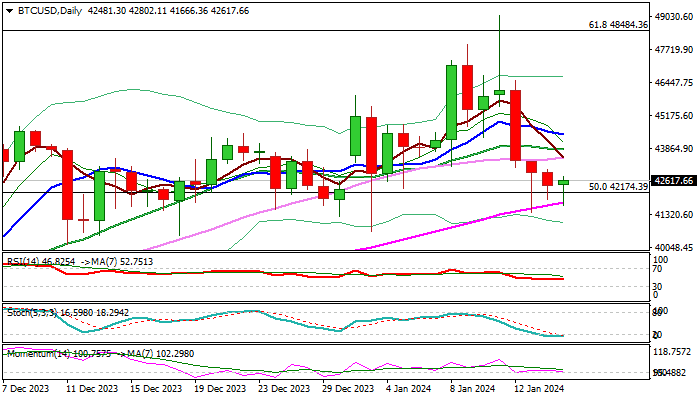

Bitcoin – slight bullish bias above daily cloud but key supports remain at risk

Bitcoin keeps slight bid in early Monday’s trading, after sharp fall in past few sessions, as daily studies are oversold, and fresh bears faced strong headwinds from rising daily cloud (top of the cloud lays at 41311).

Bitcoin spiked above 49000 on Thursday (the highest since Dec 2021) after ETF approval, but gains were short-lived.

Subsequent pullback left a daily candle with long upper shadow and also formed a bull-trap above cracked Fibo barrier at 48502 (61.8% of 68911/15485), which added to downside pressure.

Pullback found a footstep just above pivotal 40000 / 39000 support zone (base of recent range / daily cloud base) loss of which would signal deeper correction of larger rally from 2022 low (15485).

Daily studies show that momentum is still positive and slight bullish bias is to be expected while the price action stays above daily cloud, though moving average in mixed mode partially offset.

Look for stronger direction signals on breach of key levels: 44416 (10DMA) at the upside, or 39000 at the downside.

Res: 43510; 43834; 44416; 45230

Sup: 41311; 40643; 40155; 39136