Dollar index- firmer tone keeps in play hopes for test of near-term range top

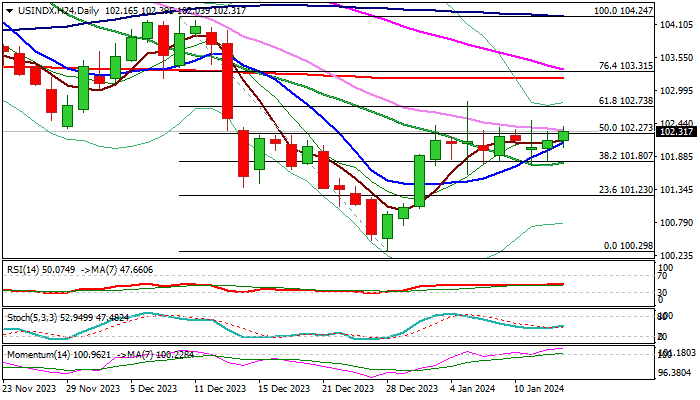

The dollar index keeps positive tone in holiday-thinned Monday’s trading and attempting again through pivotal Fibo barrier at 102.27 (50% retracement of 104.27/100.29 bear-leg), where the action failed several times recently.

Sustained break here to improve near-term picture and shift focus to the upside for potential attack at key barriers at 102.74/84 (recent range top / double-Fibo barrier) violation of which to signal continuation of recovery leg from 100.30 (Dec 28 low).

Positive momentum on daily chart and converging daily Tenkan / Kijun-sen, in attempt to form a bull-cross, underpin near-term action, though risk of extended sideways mode would persist as long as the price remains within the range.

Holding above rising 10DMA (102.12) is a minimum requirement to keep near-term bias positive.

Res: 102.50; 102.74; 102.84; 103.21

Sup: 102.12; 101.75; 101.60; 101.23