Break above 1.31 zone to signal recovery extension; Brexit remains key event for pound

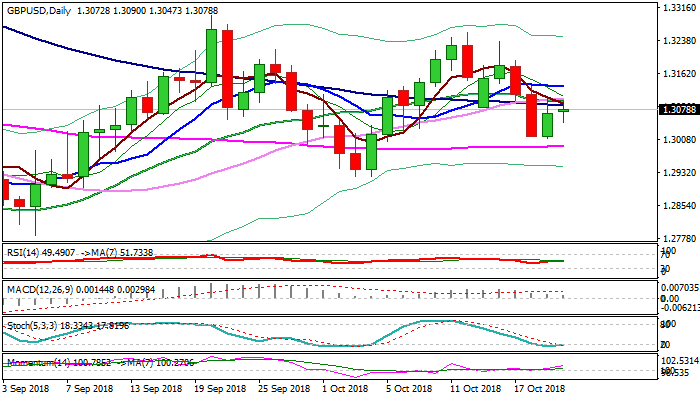

Cable maintains positive tone at the beginning of the week, following last Thu/Fri strong downside rejection at daily cloud top (1.3012) and subsequent bounce.

Bulls attack again strong resistance zone between 1.3087 and 1.3103 (100/20/30SMA / Fibo 38.2% of 1.3257/1.3011), where Friday’s recovery rally stalled.

Sustained break here is needed to signal higher base and further recovery.

Momentum remains with bulls on daily chart and slow stochastic reversed and attempting to emerge from oversold territory, supporting the recovery.

Extension above 1.3103 could challenge 1.3132 (10SMA) and 1.3163 (Fibo 61.8% of 1.3257/1.3011).

Brexit talks remain pound’s key driver and pound could take a hit if PM May’s plan (which is mostly done, but the problem with Irish border remain on the table) faces challenge from the opposition.

Negative scenario sees risk of fall below 1.30 zone and test of higher base at 1.2921, loss of which would confirm reversal.

Res: 1.3103; 1.3132; 1.3163; 1.3200

Sup: 1.3047; 1.3012; 1.3000; 1.2944