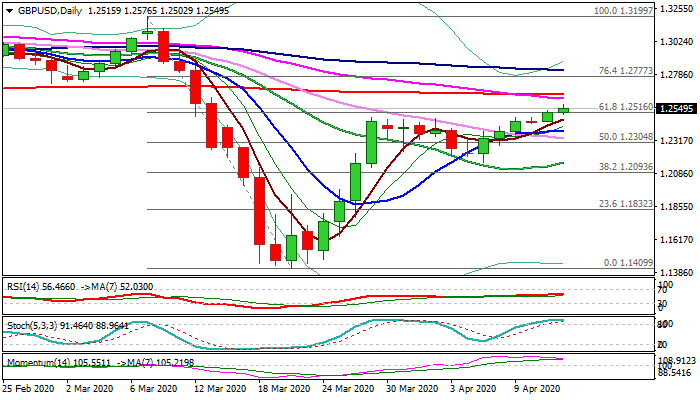

Break above key Fibo barrier shifts focus towards 200DMA

Cable extends gains above key Fibo barrier at 1.2516 (where Monday’s trading ended after registering eventual close above former high at 1.2485), hitting new highest levels since 13 Mar (1.2576 is so far European session high).

Fresh risk appetite inflates pound with weak dollar contributing, as traders so far did not seriously react on gloomy forecasts about the UK economy, which is expected to significantly slow due to pandemic lockdown.

Close above 1.2516/21 pivots (Fibo 61.8% of 1.3199/1.1409 / weekly cloud base) is needed to generate strong bullish signal for further advance towards next target at 1.2648 (200DMA).

Daily techs are overall bullish but fading bullish momentum and overbought stochastic suggest bulls may enter consolidation before continuing.

Broken barriers at 1.2521/16 and 1.2485 now reverted to solid supports, with extended dips to provide better buying opportunities while holding above 10DMA (1.2395).

Res: 1.2576; 1.2618; 1.2648; 1.2669

Sup: 1.2516; 1.2485; 1.2470; 1.2395