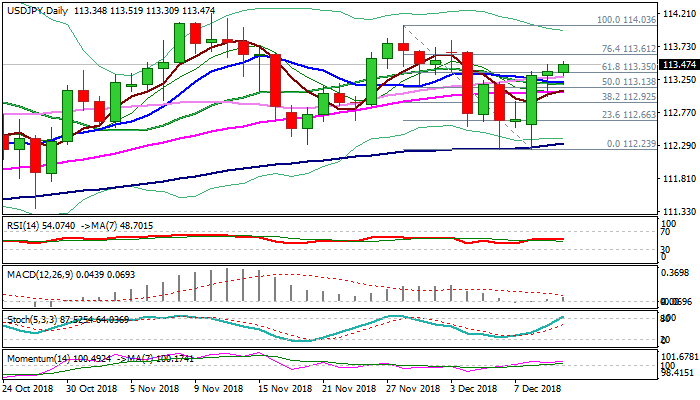

Break above pivotal 113.35 Fibo barrier opens way towards 114.00/20 targets

The pair holds in green for the third straight day and extends rally from 112.23 double-bottom through pivotal Fibo barrier at 113.35 (61.8% of 114.03/112.23 bear-leg), close above which would generate bullish signal.

The dollar was boosted by higher US treasuries and weakness of pound on rising uncertainty over Brexit.

Near-term action is underpinned by thickening daily cloud which contained recent attacks and strengthening bullish momentum.

Bulls eye target at 113.61 (Fibo 76.4%) break of which would open way towards peaks at 114.03 (28 Nov) and 114.20 (12 Nov).

Broken converged 10/20SMA’s (113.20) are expected to contain dips and keep bulls in play

Res: 113.61; 113.82; 114.03; 114.20

Sup: 113.35; 113.20; 113.08; 112.92