Break of pivotal supports opens way for deeper correction

Bitcoin is holding within tight consolidation on Friday after falling 4.8% on Thursday (the biggest daily loss since Nov 9), but remains biased lower, weighed by fresh signals that interest rates could rise further.

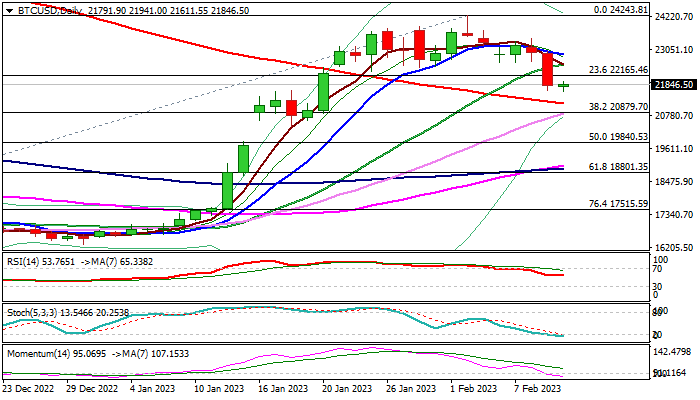

Thursday’s close below the floor near-term consolidation range under multi-month high and dip below initial Fibo support at 22165 (23.6% of 15437/24243 rally) weakened near-term structure by generating reversal signal.

Large bearish daily candle, left on Thursday, weighs on near-term action along with rising bearish momentum on daily chart, keeping the downside at increased risk.

Bitcoin is also on track for the second consecutive weekly loss, which adds to negative signals.

Initial targets lay at 21172 (200DMA) and 20879 (Fibo 38.2%), with break lower to sideline larger bulls and open way for deeper correction and threaten to fill mid-Jan 19736/20874 gap.

Oversold condition suggest that bears may take a breather before resuming, with upticks to be ideally capped by 20DMA (22543) to offer better selling opportunities.

Only sustained break above 10DMA (22888) would neutralize and shift focus to the upside.

Res: 22000; 22165; 22543; 22888

Sup: 21611; 21172; 20879; 20381