Bears look for fresh extension after recovery attempts were repeatedly rejected

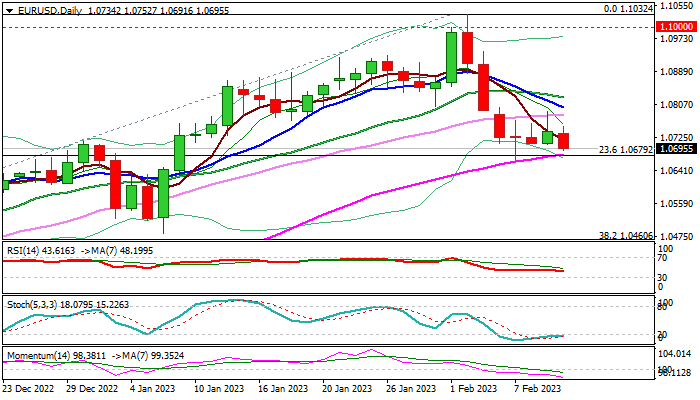

The Euro returned to weakness on Friday, signaling that brief consolidation might be over and extension of pullback from 1.1032 (Feb 2 peak) would be likely near-term scenario.

Repeated upside rejections of the action in past two days (daily candles with long upper shadows) points to strong supply and contribute to prevailing bearish stance on daily chart (rising negative momentum / 5/10; 5/20; 10/20 DMA bear crosses.

The pair is also on track for the second consecutive bearish weekly close, which contributes to formation of reversal pattern on weekly chart, as the action is additionally weighed by a bull-trap above weekly Ichimoku cloud.

Bears pressure cracked pivotal support at 1.0679 (Fibo 23.6% of 0.9535/1.1032 rally, reinforced by 55DMA), loss of which would risk deeper drop and expose next key levels at 1.0590 (top of ascending daily cloud and 1.0483/60 (Jan 6 trough / weekly cloud base / Fibo 38.2%).

Bearish bias is expected to remain intact on repeated close below daily Kijun-sen (1.0757).

Res: 1.0757; 1.0790; 1.0807; 1.0850

Sup: 1.0679; 1.0590; 1.0519; 1.0483