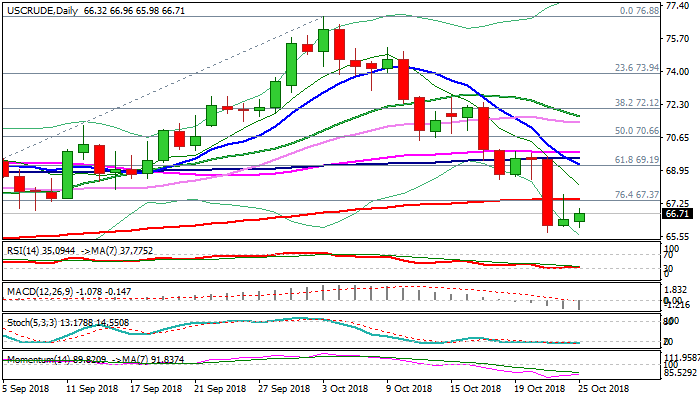

Broken 200SMA caps recovery for now

WTI oil holds steady on Thursday and attempts higher again after recovery was rejected at $67.70, after short-lived probe above strong barrier at $ $67.44 (200SMA) on Wednesday.

Wednesday’s daily candle with long upper shadow was negative signal, as fifth consecutive rise in US crude inventories (6.34 mln bls vs forecasted build of 3.69 mln bls), erased recovery.

Bears may stay on hold for extended consolidation as traders book some profits from Tuesday’s strong fall.

Consolidative phase should stay capped by 200SMA to keep strong bearish bias on negative techs / fundamentals.

Stronger recovery could be anticipated on sustained break above 200SMA, which would expose broken Fibo 61.8% of $64.43/$76.88 / falling 10SMA ($ 69.19/23) and $70 pivot (psychological barrier / Fibo 38.2% of $76.88/$65.73 fall).

Res: 66.96; 67.70; 68.48; 69.23

Sup: 65.98; 65.73; 64.84; 64.43