Bullish alignment above daily cloud but Fed eyed for fresh signal

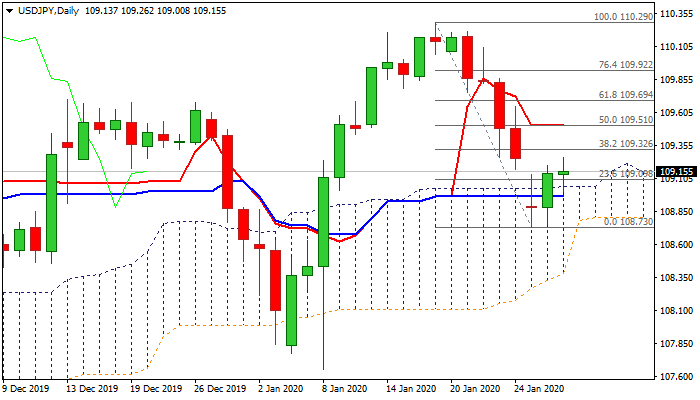

The pair holds in green and above daily cloud top after strong advance on Tuesday which in break and close above cloud, generating initial signal of daily Doji reversal pattern.

Today’s action is entrenched within narrow range and without clear direction as mixed daily techs (rising bearish momentum, flat RSI, stochastic reversing from oversold zone, MA’s in mixed setup) add to current indecision, ahead of Fed, which may give fresh direction signal.

From one side, strong negative impact from coronavirus (expectations signal that China’s Q1 GDP could drop significantly, with strong impact anticipated on global level), spreading of which would strengthen risk aversion in the markets, is seen supportive for safe-haven yen.

The dollar, on the other side, could strengthen if Fed stays pat (as widely expected) and points to increased economic risk on virus spreading that would prompt investors into greenback.

Expect stronger negative signal on pair’s weakness through 108.78/65 pivots (daily cloud base / Fibo 61.8% of 107.65/110.29) that would make the downside more vulnerable and risk attack at next key support at 108.48 (200DMA).

Upper pivot lays at 109.32 (Fibo 38.2% of 110.29/108.73) and close above would sideline downside risk for recovery extension towards 109.51 (daily Tenkan-sen) and 109.69 (Fibo 61.8%).

Res: 109.32; 109.51; 109.69; 110.00

Sup: 109.00; 108.78; 108.65; 108.48