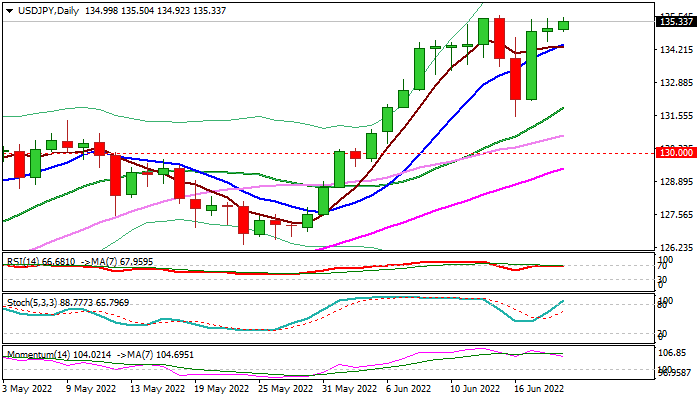

Bullish continuation is likely scenario after completion of a shallow correction

Bulls pressure a multi-year peak at 135.57 on Tuesday after shallow pullback last week, as bear-trap under 112.06 Fibo support and Friday’s bullish engulfing signaled that bulls returned to power and accelerated rebound.

Although daily studies are in full bullish setup, overbought stochastic and sideways-moving momentum, suggest bulls may face headwinds and hold in extended consolidation before fresh acceleration.

Clear break of 135.27 pivot would signal continuation of larger uptrend and expose targets at 136.98 (Fibo 138.2%) and 137.99 (Fibo 161.8%), though larger bulls will look for confirmation on a monthly close above 2002 peak at 135.16.

Rising 10DMA offers initial support at 134.42, which should hold to keep bulls intact, however, deeper dips cannot be ruled out if bulls fail to break higher, with daily Tenkan-sen (133.53) expected to contain.

Res: 136.41; 136.98; 137.99; 138.51

Sup: 134.92; 134.42; 133.53; 133.00