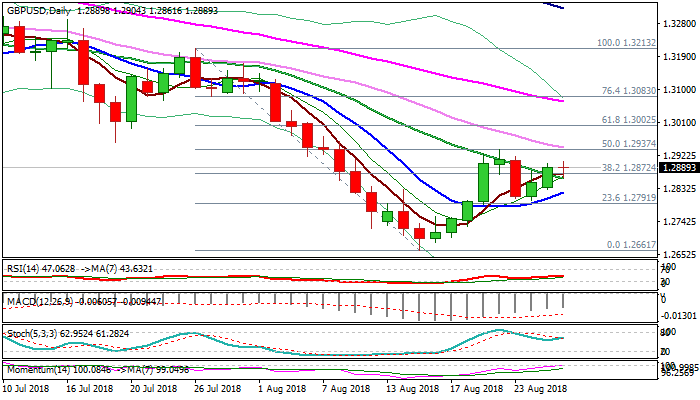

Bullish outlook above 20SMA

Two-day rally from 1.2799 (24 Aug trough) show hesitation at 1.2900 barrier on Tuesday, as Asian trading was shaped in Doji candle.

Technical studies remain positive (momentum is breaking into positive territory; slow stochastic is heading north and showing space for further upside, with action being supported by 5/20SMA bull-cross).

Monday’s close above 20SMA was bullish signal, with moving average now acting as solid support and holding today’s action (currently at 1.2859).

Bulls eye pivotal barriers at 1.2937 (22 Aug high / 50% of 1.3213/1.2661) and 1.2943 (falling 30SMA) to signal bullish continuation on firm break higher.

Conversely, break and close below 20SMA would weaken near-term structure and risk return to pivotal support at 1.2799.

Res: 1.2904; 1.2918; 1.2940; 1.2957

Sup: 1.2859; 1.2820; 1.2799; 1.2766