Bulls approach critical barriers, on track for third strong weekly rally

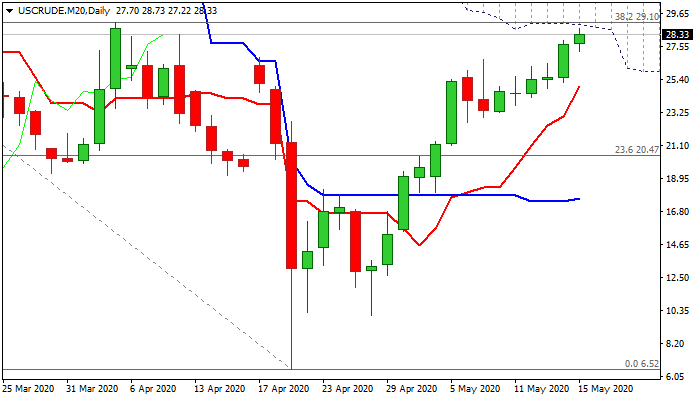

WTI oil price rose above $28 on Friday, approaching key barriers at $29.05/10 (daily cloud base / Fibo 38.2% of $65.63/$6.52).

Improved sentiment on gradual easing of lockdown measures, re-start of China’s economy and signs of further production cut, inflate oil prices.

Oil is on track for the third consecutive strong weekly gains (up 16.3% for the week so far) that adds to reversal signals.

Bulls may fail on initial attempt at critical barriers at $29.05/10 and $30 as thick falling daily cloud weighs heavily and daily stochastic is overbought, while traders may collect some profits at the end of the week.

Consolidation should stay above rising 10DMA ($24.99) to maintain bullish bias.

Break above $30 would generate strong bullish signal for extension towards $36.08 (50% retracement of $65.63/6.52) and $38.99 (falling 100DMA).

Res: 29.05; 30.00; 33.74; 36.08

Sup: 27.22; 25.77; 24.99; 23.69