Bulls are pausing ahead of ECB

Strong recovery in past three days is taking a breather on Wednesday, as traders await this week’s key event – European Central bank policy meeting on Thursday.

The ECB is expected to raise interest rates for the first time since 2011, with widely expected 0.25% hike being challenged by a change in rhetoric from the policymakers, introducing possibility for more aggressive action and 50 basis points, to fight record-high inflation in the Eurozone that resulted in Euro’s 0.85% advance on Tuesday.

Traders might be disappointed if the ECB sticks to its initial decision for 25 basis points hike that may deflated the single currency, while it may advance if the ECB opts for 50 basis points raise, though the rally is likely to be limited as expectations for Fed’s strong rate hike next week, weigh.

Daily techs slightly improved on the latest advance, but remain bearish overall that keeps the downside vulnerable.

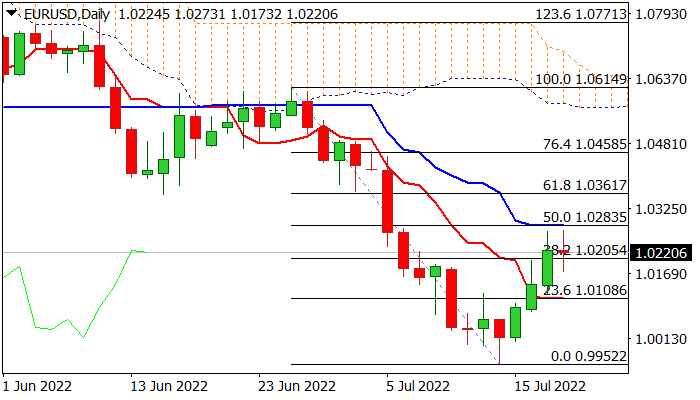

Bullish scenario requires sustained break of pivotal barrier at 1.0283 (daily Kijun-sen / 50% retracement of 1.0614/0.8852 bear-leg) to strengthen near-term structure for extension towards broken former key supports at 1.0360 zone.

Conversely, return and close below Fibo 38.2% level at 1.0205 would weaken near-term tone, with extension and close below 10 DMA (1.0111) to bring bears in play and risk renewed attack at parity level.

Res: 1.0283; 1.0300; 1.0360; 1.0400

Sup: 1.0205; 1.0173; 1.0111; 1.0000