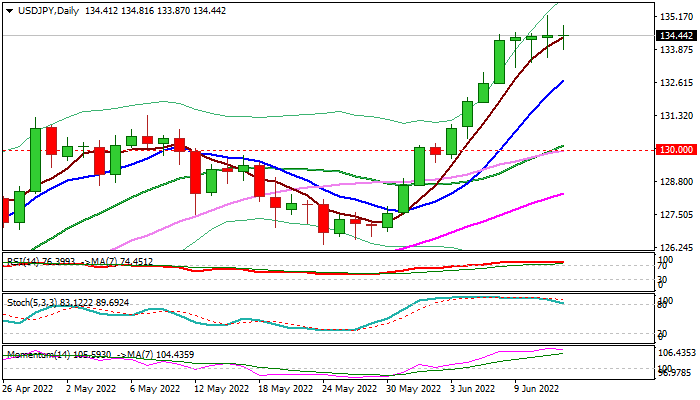

Bulls are pausing under key long-term support

Triple daily Doji and early Tuesday’s action moving within a narrow range suggest that bulls faced headwinds after initial attempt through key long-term barrier at 135.06 (2002 high).

Overbought daily studies and strong bullish momentum starting to fade, add to initial signals that the pair may hold in extended consolidation or even correct the latest upleg from 126.36 (May 24 trough).

Overall structure remains bullish, with dollar supported by rising expectations of more aggressive than expected Fed rate hike, as well as widening gap between Fed and BoJ policies.

Shallow dips should be ideally contained by rising 10DMA (132.69) with extended downticks to find ground above pivotal Fibo support at 131.82 (38.2% of 126.36/135.19 upleg) to keep bulls in play.

Only firm break here would put bulls on hold for deeper correction.

Res: 135.16; 136.32; 138.22; 139.39

Sup: 133.11; 132.69; 131.82; 131.34