Bulls are taking a breather after 1.1800 barrier resisted first attack; US data in focus

The Euro showed minor reaction on disappointing EU GDP data (Q2 -10.1% from -2% in Q2 and below 9% f/c) but remains at the back foot on Thursday.

Fed’s comments slightly dented risk sentiment and prompted investors to book some profits after the pair briefly probed above 1.1800 level and hit new nearly two-year high.

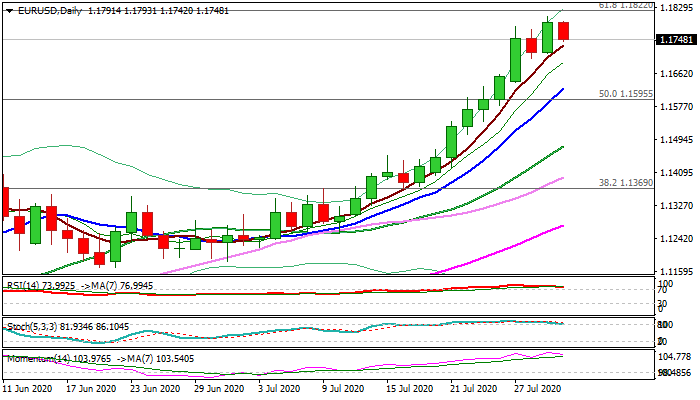

Dips on profit-taking and overbought studies are expected to provide better buying opportunities and should find ground above supports at 1.1637/22 (week’s low / rising 10DMA), to keep immediate focus at 1.1822/82 targets (Fibo 61.8% of 1.2555/1.0635 / falling 100MMA)

Today’s calendar is full (German CPI; US GDP; jobless claims due later today) with fresh signals expected on release of these indicators.

Res: 1.1805; 1.1822; 1.1848; 1.1882

Sup: 1.1731; 1.1700; 1.1622; 1.1604