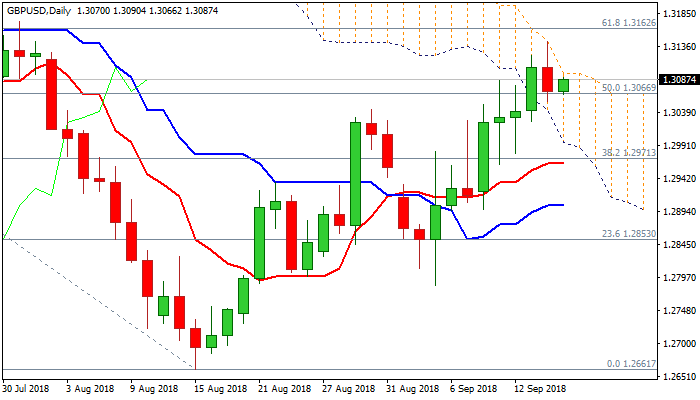

Bulls consolidate after failure at cloud top; positive outlook above 1.3000 support zone

Cable trades within thickening daily cloud on Monday, after Friday’s action was capped by cloud top (1.3143).

Subsequent pullback and Friday’s close in red, so far did not harm larger bulls, as Monday’s action holds in green for now and was contained by rising 5SMA (1.3066).

Strong bullish momentum and daily MA’s in positive configuration are supportive, but positive impact could be partially offset by south-heading slow stochastic which emerged from overbought territory, after forming bearish divergence.

Bullish outlook to remain intact while the price holds above key supports at 1.3009 (55SMA) and 1.2995 (daily cloud base).

Bulls need close above daily cloud (cloud top lays at 1.3097) to open next pivotal barrier at 1.3162 (Fibo 61.8% of 1.3472/1.2661 descend), break of which to confirm bullish continuation.

Brexit story remains key driver of the pound, with hopes of solution in the short-term, keeping sterling inflated.

From the other side, UK PM May sticks to her Brexit plan, saying that alternative would be no deal, scenario which could be harmful for sterling.

Meeting of EU leaders on Wed-Thu will be closely watched for fresh signals, along with UK inflation data, due on Wednesday.

Res: 1.3097; 1.3143; 1.3162; 1.3213

Sup: 1.3066; 1.3026; 1.3009; 1.2995