Bulls consolidate under new high ahead of Tuesday’s Brexit vote

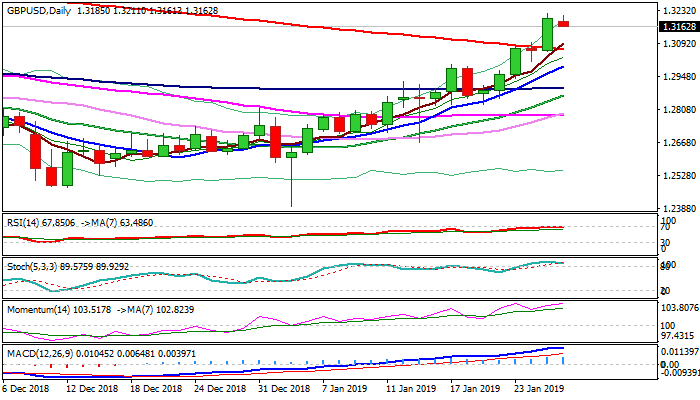

Cable consolidates under new 15-week high at 1.3217, posted on Friday after the biggest one-day rally in 2019 when the pair was up 2.5%.

Sterling rallied on newspaper report that Northern Ireland’s DUP party has decided to back PM May’s Brexit deal.

Traders may stay on hold ahead of Tuesday’s Brexit vote in the UK parliament, which is expected to trigger increase volatility.

Tuesday’s vote would also give clearer picture about parliament’s support to Brexit plan, as the parliament is still far from agreeing divorce deal, just two months ahead of Britain’s official exit from the EU on 29 March.

Technical studies remain firmly bullish on daily chart, as strong bullish signals were generated on close above 200SMA, as well as weekly close above pivotal Fibo barrier at 1.3153 (38.2% of 1.4376/1.2397 fall).

Long bullish weekly candle (last week’s rally was the biggest weekly advance since early Sep 2017) also under pins the action.

Dip-buying remains favored scenario, with initial support at 1.3153 (broken Fibo 38.2% barrier) and more significant broken 200SMA (1.3066) which is expected to hold and keep bulls in play.

Overbought studies support scenario for corrective action before bulls resume towards falling weekly cloud base (1.3317).

Negative scenario would be activated on return and close below 200SMA that would sideline bulls and signal deeper pullback.

Broken psychological 1.30 barrier, reinforced by rising 10SMA, marks next significant support.

Res: 1.3217; 1.3257; 1.3297; 1.3317

Sup: 1.3153; 1.3085; 1.3066; 1.3000