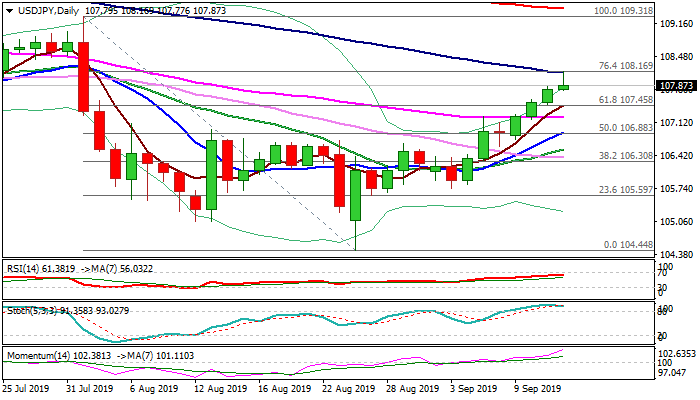

Bulls extend above daily cloud top but face headwinds from 100DMA

Bulls extended above 108 barrier and hit new six-week high at 108.16 in Asian trading on Thursday, after comments from US President Trump about delay of planned Tariffs on Chinese goods, further boosted risk sentiment.

Wednesday’s close above daily cloud (the price returned above cloud for the first time since early May) was bullish signal that adds to positive sentiment.

Fresh extension of the third wave (from 105.73) of five-wave cycle from 104.44 (26 Aug low) confirmed wave principles on break above its FE100% (107.98), but bulls faced headwinds from falling 100DMA (108.14) and Fibo 76.4% of 109.31/104.44 (108.16).

Bullish momentum is in steep rise on daily chart and underpins the advance, but strongly overbought stochastic warns that bulls may take a breather and consolidate before resuming.

Broken daily cloud top offers immediate support at 107.71, with dips expected to find ground above broken Fibo barrier at 107.45 (61.8% of 109.31/104.44 / rising 5DMA) to keep bulls intact.

Firm break above 108.14/16 pivots would open way for 109+ extension.

Caution on dip below broken 55DMA (107.21) that would risk deeper pullback and sideline bulls.

Res: 108.16; 108.84; 109.00; 109.31

Sup: 107.77; 107.45; 107.21; 106.88