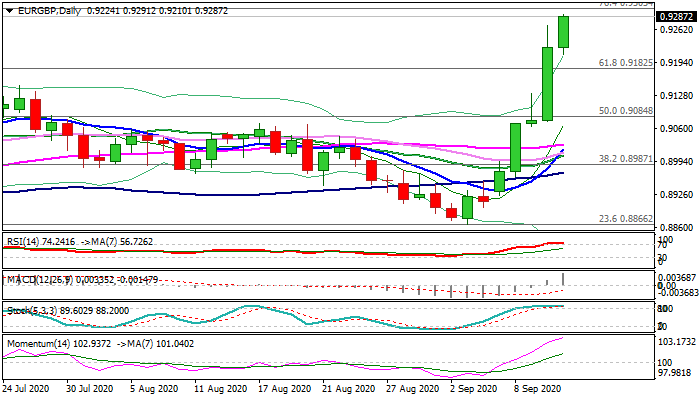

Bulls extend to new 5 1/2 month high, ignoring so far overbought daily studies

The cross holds firmly in green for the fifth straight day and hits new 5 ½ month high, on track for impressive weekly advance (so far up 3.6% in the biggest weekly rally since the second week of March).

Thursday’s surge and close above pivotal barriers at 0.9175/82 (29 June high / Fibo 61.8% of 0.9498/0.8670 descend) generated strong bullish signal and exposed targets at 0.9293/0.9303 (Fibo 138.2% projection of the upleg from 0.8865 / Fibo 76.4% retracement of 0.9498/0.8670), violation of which would open way for test of 2020 high at 0.9498 (19 Mar).

Optimistic tone from ECB inflated the euro and increase pressure on sterling, already heavily weighed by growing fears on no-deal Brexit scenario.

Weekly studies are highly supportive, but overbought daily conditions warn that bulls may take a breather before resuming, with dips expected to provide better buying opportunities.

Res: 0.9303; 0.9366; 0.9412; 0.9498

Sup: 0.9210; 0.9182; 0.9147; 0.9084