Bulls eye 2020 highs and monthly cloud top

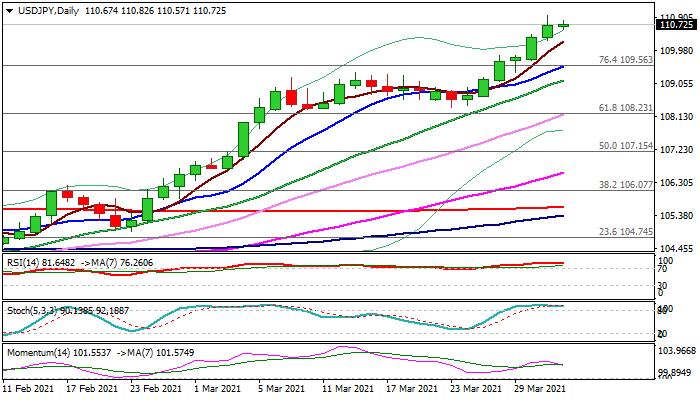

The pair holds in green for the seventh straight day and bulls have tighten grip after break of pivotal barriers at 109.56/110.00 (Fibo 76.4% of 111.71/102.59 / psychological).

The dollar advanced nearly 8% vs yen in past three months and strong acceleration in March (up 3.9% for the month) left a massive bullish candle (the biggest one-month rally since November 2016).

Bulls eye targets at 111.71 (Mar 202 peak and 112.25 (2020 high), break of which would open way for attack at monthly cloud top (112.41), as March rally penetrated the cloud, spanned between 110.51 and 112.41.

Daily studies are in full bullish setup but strongly overbought stochastic and RSI warn of consolidation before bulls resume.

Former pivotal barriers at 110.00 and 109.56 (Fibo 76.4%, reinforced by rising 10DMA) reverted to solid supports which should keep the downside protected.

Res: 111.00; 111.28; 111.71; 112.25

Sup: 110.57; 110.27; 110.00; 109.56