Bulls eye targets at 1.1499 and 1.1515 as greenback did not react on optimistic tone from Fed’s Williams

The Euro wakes up in early European trading on Tuesday and ticks higher after the action in Asia was quiet and moved within tight range.

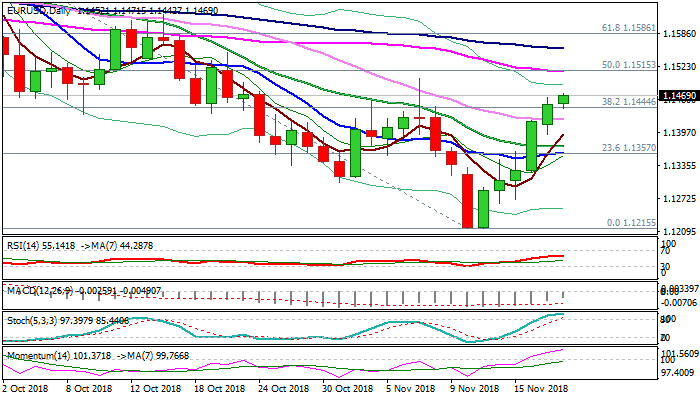

The pair remains in green for the sixth straight day and looks for extension of bull-leg from 1.1215 double-bottom (12/13 Nov) towards targets at 1.1499 (07 Nov spike high) and 1.1515 (Fibo 50% of 1.1815/1.1215 descend / 55SMA).

Bulls remain in play despite rather hawkish comments from Fed’s Williams on Tuesday who signaled that the Fed may stay on track for rate hike in Dec, as dollar showed mild reaction on comments, staying at the back foot.

Earlier comments from Fed’s vice chair Clarida, who expressed concerns about global growth slowdown which could also impact US economy and pre-US holiday position adjustment, keep the greenback under pressure that could provide further support to the single currency.

Monday’s close above 1.1444 pivot (Fibo 38.2% of 1.1815/1.1215) was bullish signal, with strong bullish momentum on daily chart and multiple MA’s bull-crosses (5/10 and 5/20) underpinning.

Also, next week’s twist of thinning daily cloud is expected to be magnetic.

Broken Fibo barrier at 1.1444 holds today’s action for now, with broken 30SMA (1.1421) expected to contain deeper dips and keep bulls intact.

Res: 1.1499; 1.1515; 1.1558; 1.1586

Sup: 1.1444; 1.1421; 1.1393; 1.1371