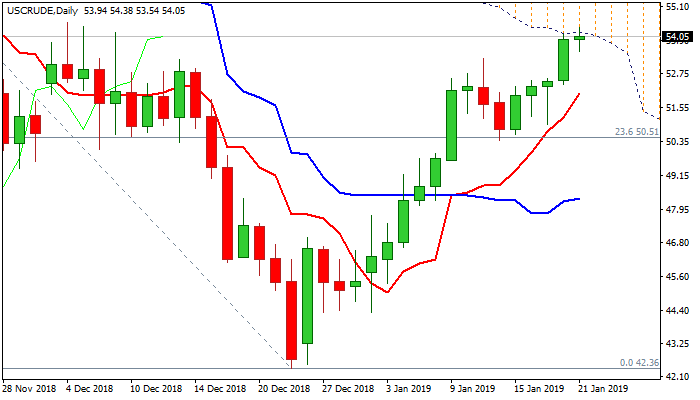

Bulls face strong headwinds at daily cloud base but remain in play

WTI oil consolidates under new 2019 high at $54.38, posted earlier today, as bulls face strong headwinds from the base of thick falling daily cloud ($54.19) which was cracked today but so far without clear break.

Friday’s long bullish daily candle, left after nearly 3% daily rally, underpins the action, but the price may hold in extended consolidation under daily cloud as overbought slow stochastic and bearish divergence on 14-d momentum warns.

Converged 10/55SMA’s ($52.14) are attempting to form bulls cross and mark solid support which is expected to contain extended dips and keep bulls in play.

Eventual close within daily cloud would open pivot at $55.55 (Fibo 38.2% of $76.88/$42.36), break of which would generate bullish signal for extension of recovery from $42.36 low (24 Dec).

Chinese data released today showed economic slowdown in line with expectations, having minor impact on oil price for now, as bullish sentiment remains boosted on OPEC output cut and hopes of solution for US-China trade dispute.

Dip-buying remains favored above 10/55SMA’s and only sustained break here would signal recovery stall at daily cloud base and deeper pullback.

Res: 54.19; 54.38; 54.54; 55.55

Sup: 53.54; 52.96; 52.14; 50.97