Turkish lira maintains positive tone despite bad news; 200SMA marks key support

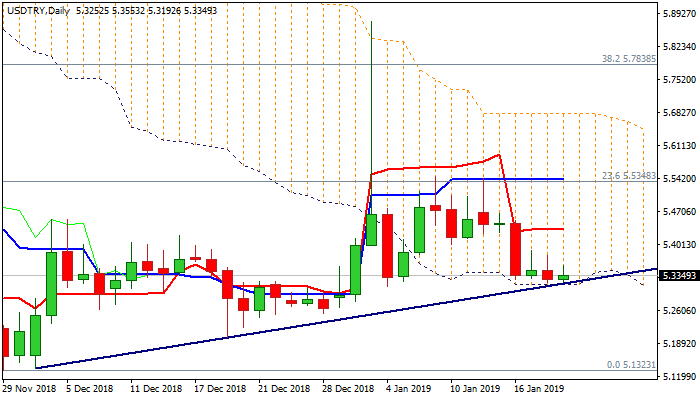

The pair remains at the back foot, following recent double-rejection at 5.5450 zone that left a double-top ahead of subsequent acceleration lower.

Fresh weakness pressures key support at 5.3160 (daily cloud base / bull-trendline off 5.1323 low) break of which would generate strong bearish signal for further retracement of 5.1323/5.5450 recovery leg.

Daily MA’s turned to negative setup and along with south-heading momentum and MACD, maintain bearish pressure, which could be partially offset by deeply oversold slow stochastic.

Lira maintains positive tone despite a number of bad news, which include higher oil prices and China’s slowdown.

In addition, recent data showed Turkish economy is struggling as trade gap widened to 2.6 bln in Dec vs 0.6 bln in Nov, while imports plunged.

CBRT’s 24% interest rate keep lira in good shape, however, overall fragile picture warns that recent bulls could run out of steam and spark fresh weakness of Turkish currency. Rising 200SMA (5.2427) marks pivotal support which should ideally contain and keep recent USDTRY’s bears under control.

Bearish signal could be expected on break below 200SMA which would expose key supports at 5.1323 (25 Nov low of pullback from new record high) and psychological 5.50 support.

Res: 5.3669; 5.4051; 5.4512; 5.5413

Sup: 5.3160; 5.2779; 5.2539; 5.2427