Bulls focus 2020 high but may take a breather before final break

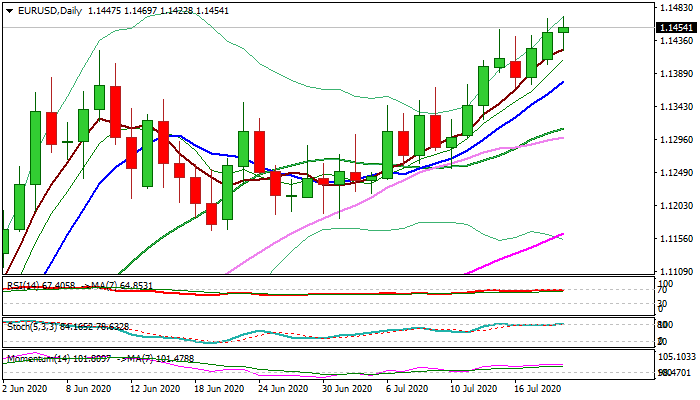

The Euro maintains bullish tone and posted new marginally higher high at 1.1469 today, as eventual agreement between EU leaders about recovery fund boosted risk appetite.

Bulls eye 2020 high at 1.1495, posted on 9 Mar, with break here expected to open way for extension of recovery from 2020 low (1.0635) towards 1.16 zone.

The pair gained strong bullish signal on last week’s close above 1.1336/69 (200WMA / Fibo 38.2% of 1.2555/1.0635, 2018/2020 fall) after multiple breaches failed to register close above this levels.

Positive fundamentals are complemented by bullish studies on daily / weekly charts, however, hesitation at 1.1495 barrier cannot be ruled out as daily stochastic is overbought and daily Tenkan-sen and Kijun-sen turned sideways.

Consolidation is likely to precede final push through 1.1495, with dips expected to offer better opportunities to re-join bullish market.

Former high at 1.1422 and round-figure 1.1400 offer initial supports, with rising 10DMA (1.1378) expected to contain and keep bulls intact.

Res: 1.1469; 1.1495; 1.1519; 1.1579

Sup: 1.1422; 1.1400; 1.1378; 1.1362