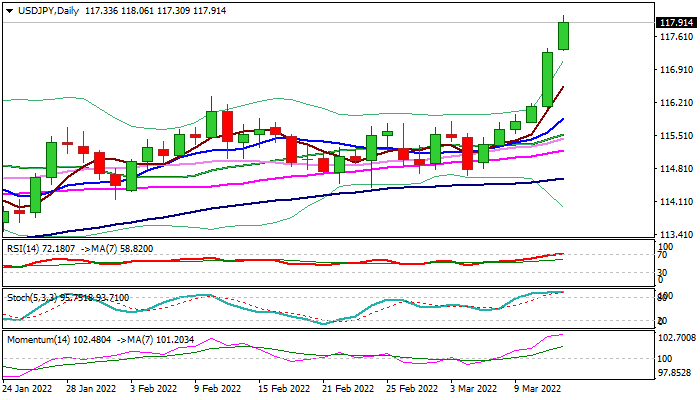

Bulls further tighten grip after last week’s 2% advance, ahead of Fed

The USDJPY extends its steep ascend on Monday, following nearly 1% rise on Friday, the biggest daily advance since November 2020.

Fresh acceleration (0.5% up until early US session on Monday) cracked 118.00 barrier, opening way for test of Dec 2016 peak (118.66) and unmasking pivotal Fibo barrier at 119.50 (76.4% retracement of 125.84/98.99 fall).

The dollar remains well supported by uncertainty over the war in Ukraine that keeps investors in the safety, with expectations for Fed rate hike on Wednesday, adding to positive sentiment, while divergence between the Fed and BoJ, as Japan’s central bank is likely to stay on hold for some time, prompting stronger selling of yen.

Overbought daily studies is the only signal that may slow bulls, however a massive weekly candle (the pair was up 2% last week) continues to underpin, with shallow dips to offer better buying opportunities under the current circumstances.

Traders focus on Fed’s decision, with 0.25% hike widely expected and all attention will be on Fed’s short-term plans – the pace of raising rates and projections for this year and 2023/24, in attempts to tame raging inflation, which rose to the highest in forty years.

Only more dovish than expected stance from the FOMC, would negatively impact strong bulls.

Res: 118.06; 118.66; 119.00; 119.50

Sup: 117.53; 117.07; 116.66; 116.33