The dollar remains firm on geopolitical tensions and wide expectations for Fed rate hike

The dollar index edged lower in European session on Monday, after hitting a session high (99.28) in Asian and still holding positive sentiment, despite reviving risk sentiment on fresh optimism over Russia – Ukraine ceasefire talks.

The index is trading near new highest in almost two years (99.41) being lifted by strong risk aversion caused by growing uncertainty over the war in Ukraine and potential consequences on the global economy.

The dollar is expected to remain strongly supported by geopolitical factor, unless the conflict de-escalates significantly, with strong expectations that the US federal Reserve will raise interest rates for the first time after pandemic, in their policy meeting this week.

Economists do not expect war tensions to derail the central bank widely expected 0.25% hike this month, as soaring inflation maintains pressure on the policymakers to start tightening and fight strong price pressures.

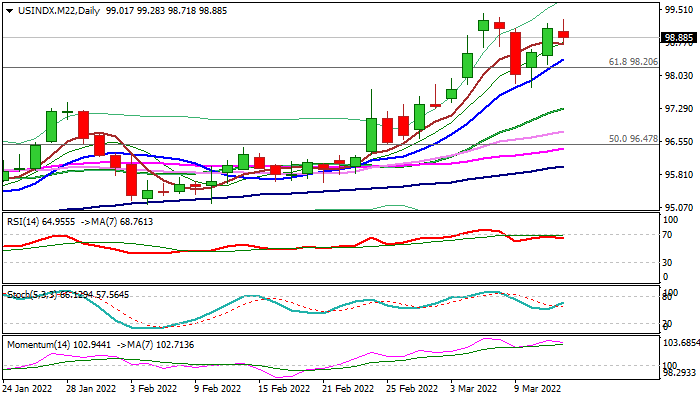

Bullish technical studies on all larger timeframes are supportive for further advance, with dips to ideally stay above solid supports at 98.38/20 (rising 10DMA / broken Fibo 61.8% of larger 103.80/89.15 fall) and keep bulls in play for retest of 2022 high (99.41) and attack at psychological 100 barrier, violation of which would expose 100.34 (Fibo 76.4%).

Caution on loss of 98.20 handle that would soften near-term tone and risk attack at 97.76 (Mar 10 trough) break of which would complete a failure swing pattern on daily chart and generate initial signal of reversal.

Res: 99.28; 99.41; 100.00; 100.34

Sup: 98.71; 98.38; 98.20; 97.76