WTI oil is on track for strong weekly drop on improved sentiment, but traders remain cautious

WTI oil price edged higher on Friday but remains below $110 per barrel for now, after falling sharply in past two days on optimism of de-escalation of the conflict in Ukraine and easing concerns about stronger disruption of global oil supply.

Oil prices surged to the highest since 2008 earlier this week after the US banned Russian oil imports and markets feared further bans of imports from the world’s top oil exporter would strongly impact oil market.

Although markets remain highly alerted on possible fresh escalation that would quickly lift oil prices, fresh optimism continues to prevail, with oil on track for weekly close in red and the weekly fall of over 12%.

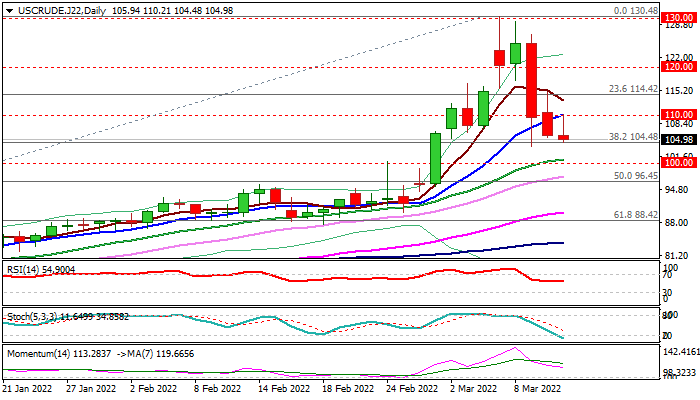

Friday’s close below $110 level would add to signals for deeper pullback as daily studies show fading bullish momentum, however, bears need a clear break of cracked pivotal Fibo support at 104.48 (38.2% of $62.42/$130.48 upleg) to confirm signal and expose psychological $100 support.

Caution on failure to break 104.48 pivot that would signal that near-term bears are running out of steam, but near-term action is expected to remain biased lower while holding below $110 level.

Only sustained break above $110 would ease downside risk and generate initial signal of the bottom.

Res: 106.80; 108.96; 110.00; 112.88

Sup: 104.47; 103.67; 100.49; 100.00