The pair could extend to 2017 high in dollar-positive environment

The USDJPY accelerated strongly higher on Friday (up around 0.7% in Asia / Europe), extending steep rally into fifth straight day.

Strong US inflation data (Feb CPI soared to the highest since 1982) fuel expectations for Fed rate hike in the next week’s policy meeting (0.25% hike is widely expected, but some bet for 0.5% increase) and add to dollar’s strength, as the greenback has been lifted by safe-haven buying on risk aversion over the conflict in Ukraine.

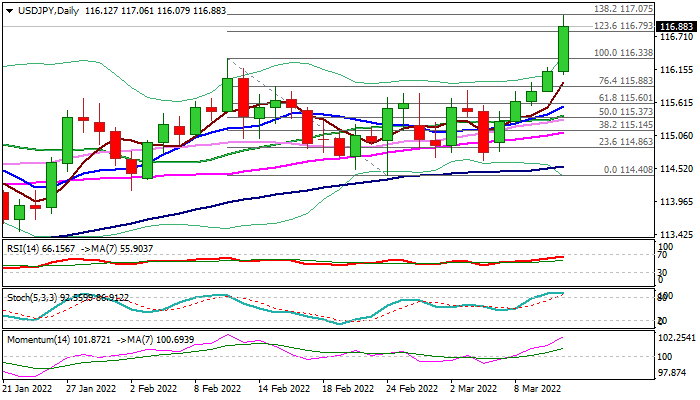

Fresh bullish acceleration broke above former 2022 high (116.35, posted on Jan 4) and probed above 117 level, hitting the highest levels since Jan 2017.

Bulls can extend further and attack Dec 2016 high (118.66) as fundamentals remain favorable for the dollar, with no significant obstacles on the way, supporting the notion.

Daily studies continue to support the action as 14-d momentum remains in steep ascend and north heading MA’s in full bullish setup, continue to track the price action.

The pair is on track for strong weekly advance (around 1.7%) and massive bullish weekly candle is expected to underpin.

Dips are expected to offer better buying opportunities, with former tops (116.33/35) now acting as strong supports which should keep the downside protected

Res: 116.79; 117.07; 117.53; 117.81

Sup: 116.70; 116.35; 116.07; 115.88