Recovery stall and formation of bull trap weigh on euro

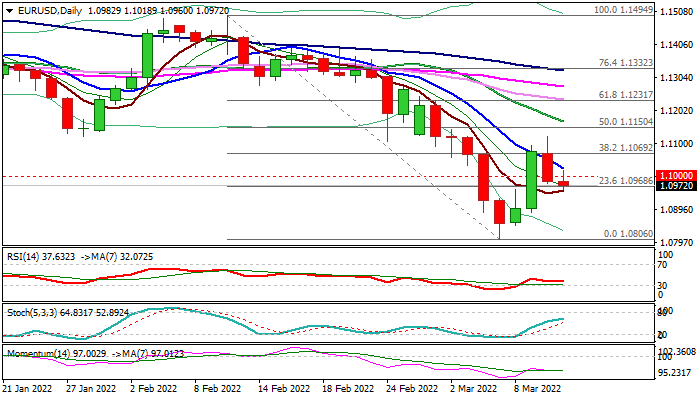

The Euro extends weakness in early Friday after strong recovery from multi-month low (1.0806) lost traction and quick pullback resulted in bearish close on Thursday (big red daily candle with long upper shadow).

The sentiment weakened by rising growth risks that offset the impact from ECB’s unexpectedly hawkish stance, while strong US inflation report added to hopes for Fed’s rate hike next week and lifted dollar.

With 50% of two-day 1.0806/1.1121 rebound being retraced so far, recovery phase is likely over and weekly close below 1.10 level to confirm bears back in play.

Bearish signal was generated on formation of bull-trap on daily chart after recovery repeatedly failed to sustain break above pivotal Fibo barrier at 1.1069 (38.2% of 1.1494/1.0806) and subsequent pullback completed the pattern.

Daily studies support negative scenario as 14-d momentum turned south after brief recovery and remains deeply in the negative territory, while moving averages remain in bearish configuration after the price action repeatedly failed to clearly break above initial obstacle (falling 10DMA).

Near-term bias is expected to remain with bears while the price action continues to trade below 1.10 level, with extension below 1.0926 (Fibo 61.8% of 1.0806/1.1121 upleg) to confirm reversal.

Conversely, return and close above 1.10 handle would ease downside pressure, however, near-term action would remain without clear direction below cracked pivot at 1.1069 (Fibo 38.2% of 1.1494/1.0806) and only firm break here would bring bulls fully in play.

Res: 1.1000; 1.1023; 1.1046; 1.1095

Sup: 1.0957; 1.0926; 1.0880; 1.0848