Bulls look for adjustment before resuming; Fed is in focus today

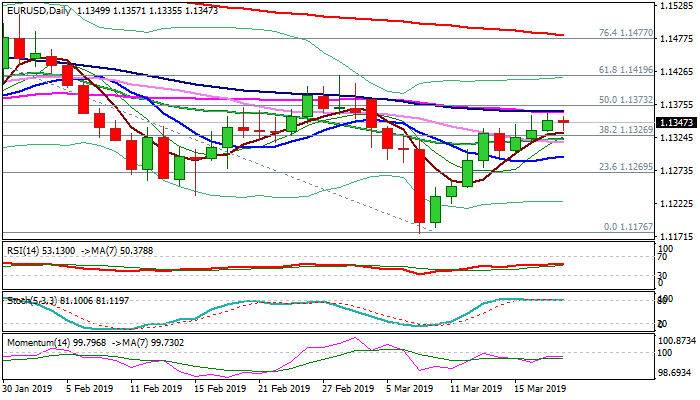

The Euro holds in red on Wednesday’s morning, weighed by overbought conditions and lack of momentum and stronger dollar on increased safe-haven demand, following reports on fresh tensions in US/China trade talks. after extension of broader rally ran out of steam at 1.1363 barrier (converged 55/100SMA’s) on Tuesday.

Overall picture remains positive and favors final attack at 1.1363/73 pivots (55/100SMA’s / 50% of 1.1569/1.1176), clear break of which would expose thickening daily cloud (1.1393/1.1413).

Bulls look for adjustment before fresh upside attempts, with dips to be ideally contained by converged 20/30SMA’s (1.1321/16).

Bulls would be questioned on bearish extension below 10SMA (1.1295).

Traders turn focus towards Fed’s announcement, due later today, with the central bank widely expected to keep overnight interest rates unchanged and likely turn more dovish on rising bets on potential rate cut.

Res: 1.1363; 1.1373; 1.1393; 1.1413

Sup: 1.1335; 1.1321; 1.1316; 1.1295