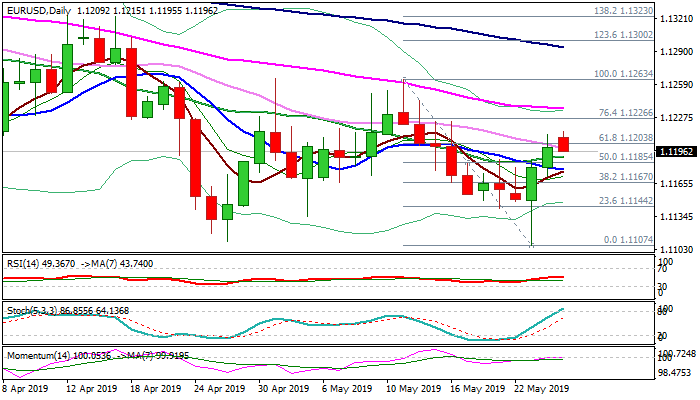

Bulls look for confirmation on close above 1.12 barrier; 10SMA marks pivotal support

The Euro eases in early European trading on Monday and cracks 1.1200 support after hitting new, marginally higher 1 ½ week high at 1.1215 in Asia, but still holds firm tone following last week’s strong downside rejection and subsequent bounce.

Recovery from last Thursday’s spike low at 1.1107 retraced over 61.8% of 1.1263/1.1107 bear-leg and keeps near-term focus at the upside as bullish momentum continues to rise and underpin the action.

On the other side, overbought stochastic warns of corrective easing.

Broken 20SMA (1.1190) marks initial support, with dips expected to find ground above converged 5/10SMA’s (1.1177) to keep bulls in play.

Results of Euro elections showed pro-Eu parties managed to hold majority in the EU parliament and limit gains of their opponents from nationalist bloc that gives slight support to the single currency.

Bulls look for confirmation on close above cracked pivots at 1.1198 (30SMA) and 1.1203 (Fibo 61.8% of 1.1263/1.1107 bear-leg) that would open way for extension towards 1.1226/36 (Fibo 76.4% / 55SMA).

Conversely, break and close below 10SMA would shift near-term bias to the downside and signal an end of corrective rally.

Res: 1.1203; 1.1215; 1.1226; 1.1236

Sup: 1.1190; 1.1177; 1.1156; 1.1142