Bulls may accelerate on break of 2021 high

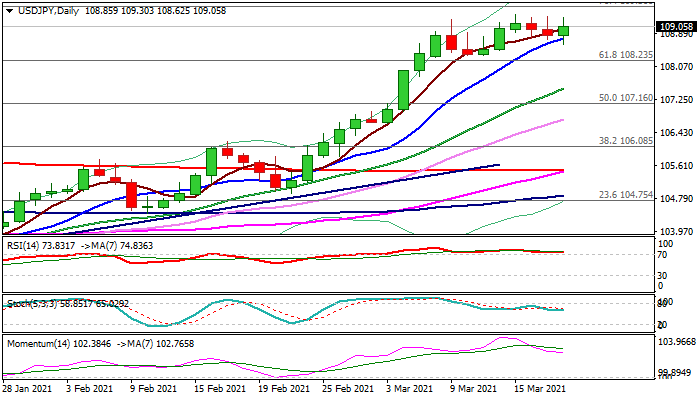

The pair remains within a narrow range under new 2021 high (109.36) as the dollar regained footing after being hit by dovish Fed on Wednesday.

Near-term action continues to trade above rising 10DMA which tracks the advance since Feb 24, keeping bias with bulls.

Daily moving averages are in full bullish setup, but loss of positive momentum and RSI ranging in overbought territory partially offset positive signals and warn of extended consolidation, but last Friday’s marginal close above 200WMA (108.99) and the pair being on track for the second weekly close above the indicator that would add to positive stance.

Bulls eye key barriers at 109.56/85 (Fibo 76.4% of 111.71/102.60 / 5 June 2020 high), violation of which would expose psychological 110 barrier and monthly cloud base (110.50).

Rising 10DMA (108.76) offers solid support, ahead of key levels at 108.33/23 (Mar 10 low / broken Fibo 61.8%), loss of which would put bulls on hold and signal deeper pullback.

Res: 109.36; 109.56; 110.00; 110.50

Sup: 108.76; 108.47; 108.23; 107.51